Utah County Property Appraiser

Utah County Assessor

Utah County Assessor What the Assessor’s Office Does What the Assessor’s Office Does The Utah County Assessor’s Office determines the assessed value of real property and personal property for tax purposes. It maintains accurate property records and ensures properties are valued accurately and equitably according to Utah State Tax Code.

https://assessor.utahcounty.gov/

Real property

Real property includes land, buildings, and any permanent structures or improvements attached to the land. Real property is taxed in Utah to generate revenue for local governments, funding services like schools, infrastructure, and public safety. The Land Records page lets you search by name, address, or serial number to find property details, subdivisions, taxes, and appraisals.

https://assessor.utahcounty.gov/real-property

Utah County holds public hearing on proposed 2026 budget News, Sports, Jobs - Daily Herald

Utah County holds public hearing on proposed 2026 budget Utah County held a public hearing Wednesday for its proposed 2026 budget, which is scheduled to be approved and adopted by the Board of Commissioners on Dec. 17. On the heels of a 48% property tax hike in 2025, the county does not plan on raising taxes this year.

https://www.heraldextra.com/news/2025/dec/05/utah-county-holds-public-hearing-on-proposed-2026-budget/

HB0046

H.B. 46 Taxpayer Information Sharing Amendments Rep. Shelley, Troy proposes the following substitute bill: 1 Taxpayer Information Sharing Amendments2 3 LONG TITLE4 General Description:5 This bill provides for information sharing between the Driver License Division and county 6 7 Highlighted Provisions:8 This bill:9 ▸authorizes the Driver License Division to disclose certain driver license information to 10 11 ▸limits the use of driver license ...

https://le.utah.gov/~2026/bills/static/HB0046.html

2026 Business Personal Property Signed Statement Forms Box Elder County, UT

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled "Explore your accessibility options".

https://www.boxeldercountyut.gov/272/2026-Business-Personal-Property-Signed-S

Personal Property

The Utah County Assessor is responsible for the equitable and fair assessment of all taxable properties in Utah County. Personal Property is valued based on schedules developed by the Utah State Tax Commission. All non-exempt tangible personal property is valued and assessed annually by the Personal Property Division of the Assessor's Office.

https://assessor.utahcounty.gov/personal-property

2026 Budget and Tax Increase - Mayor Salt Lake County

2026 Budget and Tax Increase The 2026 Salt Lake County budget was passed with a property tax increase of approximately 14.65%, which equals less than $6.00 per month for the average homeowner (based on a $638,000 home value). The tax increase only applies to Salt Lake County's portion, which is about 17% of your total property tax bill.

https://www.saltlakecounty.gov/mayor/2026-budget-tax-increase/

🗞️ Utah County News Roundup 🏛️ 2026 County Budget Update Utah County held a public hearing on its proposed 2026 budget with no new tax increase planned following last year’s hike. The $168.9M general fund proposal includes higher projected revenue from property and sales taxes, increased personnel funding across key departments, and a possible up to 2% pay raise for department heads and elected officials, pending approval later this month.

https://www.instagram.com/p/DSSg9z4k3hH/

2025 and 2026 Small DDAs and QCTs HUD USER

The 2026 Qualified Census Tracts (QCTs) and Difficult Development Areas (DDAs) are effective January 1, 2026. The 2026 QCT designations use tract boundaries from the 2020 decennial census. The 2026 metro DDAs use ZIP Code Tabulation Area (ZCTA) boundaries from the 2020 decennial census.

https://www.huduser.gov/portal/sadda/sadda_qct.html

Washington County of Utah County News at your fingertips

Discover Your County. Assessor Info Residential exemption application, estimate taxes, and search property characteristics. Recorder Info Ownership Records, Maps, Property Watch, Recording Fees & Requirements Tax Info Look up property tax information and history by account or parcel number. Maps Interact, search, and download with many types of maps about our county.

https://www.washco.utah.gov/

2025 and 2026 Small DDAs and QCTs HUD USER

The 2026 Qualified Census Tracts (QCTs) and Difficult Development Areas (DDAs) are effective January 1, 2026. The 2026 QCT designations use tract boundaries from the 2020 decennial census. The 2026 metro DDAs use ZIP Code Tabulation Area (ZCTA) boundaries from the 2020 decennial census.

https://www.huduser.gov/portal/sadda/sadda_qct.html

Official Site of Cache County, Utah - Assessor's Office

Assessor's Office The County Assessor's Office holds the responsibility of appraising all taxable real property within the county. Its main objective is to determine the market value of these properties through the appraisal process. Market value is commonly defined as the amount that a willing buyer would pay to a willing seller, representing the price at which the property could be sold.

https://www.cachecounty.gov/assessor/

Property Page Summit County, UT - Official Website

Assessor Values Map - Visualize various aspects of the county assessment such as market and taxable values, the area factor rate, quality, year built and square footage. County Road Map - Interactive Map of Public Roads in Summit County. Restaurant Inspections - View recent Restaurant Inspections performed by the Summit County Health Department.

https://www.summitcountyutah.gov/1013/Property-Page

Homeowner’s Tax Credit Application Deadline – 2026 Utah State Tax Commission

2026 – Homeowner’s Tax Credit Application Deadline The TC-90CY,Low-income Abatement and Homeowner’s Tax Credit Application is due by September 1 – submitted to the county where the home is located. For more information, contact your county government listed on the form.

https://tax.utah.gov/event/homeowners-tax-credit-application-deadline-2026-4/

Assessor's Office 2026 Detail Review of Property Characteristics Box Elder County, UT

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled "Explore your accessibility options".

https://www.boxeldercountyut.gov/274/Assessors-Office-2026-Detail-Review-of-P

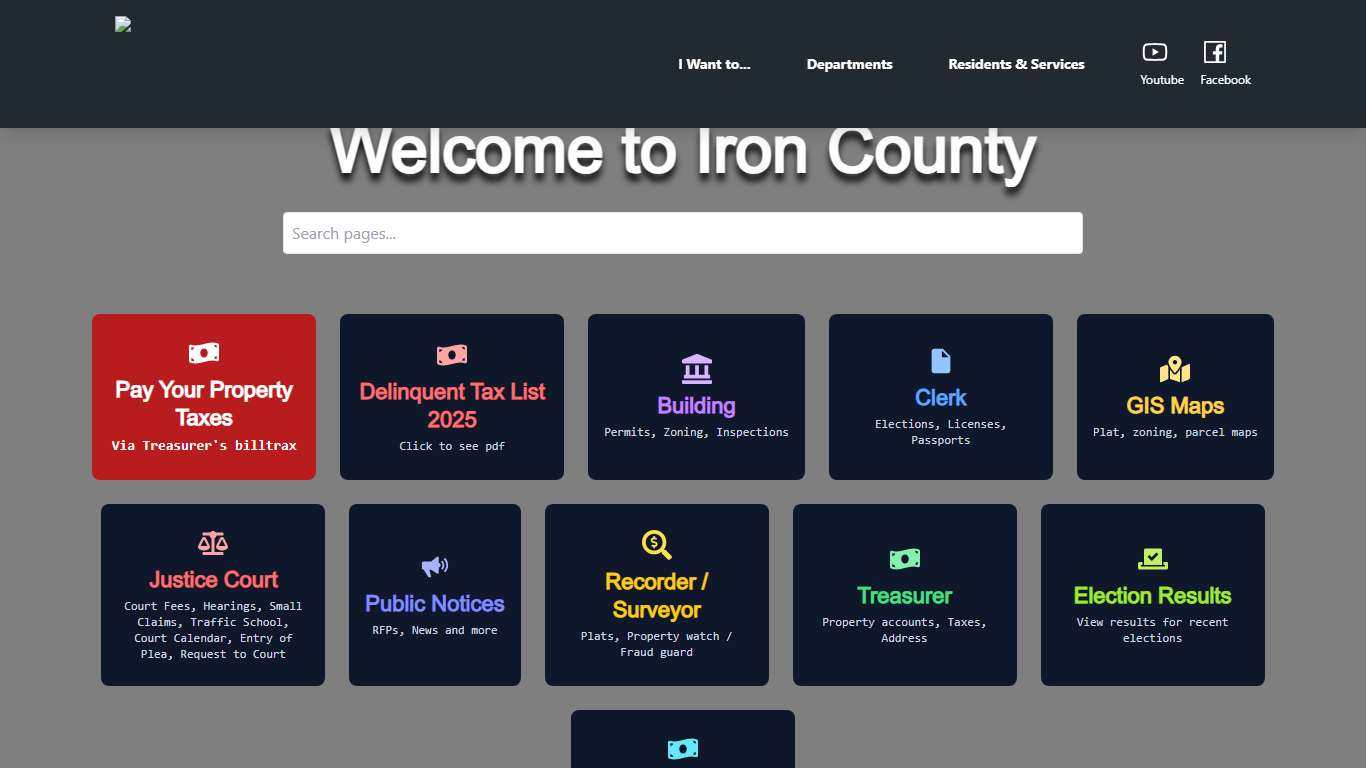

Iron County

Welcome to Iron County Public Notices 2026 Commission Meeting Schedule 2026 Iron County Commision Meeting Schedule. 2025 Delinquent Tax List Unpaid 2025 property taxes and/or special assessments in Iron County, Utah became delinquent on December 2, 2025. Chemical Bid: Due January 16, 2026, at 5:00 P.M The Iron County Noxious Weed Dept.

https://ironcountyut.gov/

Salt Lake County proposes 2026 budget which includes a nearly 20% property tax increase - YouTube

NaN / NaN In this video Transcript Description 4Likes 732Views Oct 212025 How this was made Auto-dubbed Audio tracks for some languages were automatically generated. Transcript Follow along using the transcript. Show transcript KSL News Utah 455K subscribers Transcript Show more...

https://www.youtube.com/watch?v=1o32_iWLuDA&vl=en-US